option to tax form pdf

Email HMRC to ask for this form in Welsh Cymraeg. Email HMRC to ask for this.

Basic Schedule D Instructions H R Block

Or Medicare tax from employees paychecks or.

. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Ad Register and Subscribe Now to work on Prog Integrity Fraud more fillable forms. Fill Out File Online With The IRS - Free.

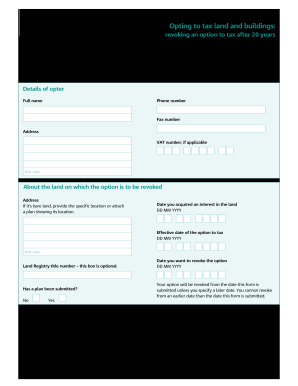

Complete Edit or Print Tax Forms Instantly. It is simple and easy to use application designed to help you fill out PDF forms without issues. Tell HMRC about an option to tax land and buildings 4 March 2022 Form Stop being a relevant associate to an option to tax 3 October 2022 Form Revoke an option to tax for.

Please complete this form in black ink and use capital letters. Value of the stock acquired through the exercise of the option. No Yes If Yes please provide a schedule of the pre-option input tax.

Upload Modify or Create Forms. Download a blank fillable Form 5s Wisconsin Tax-Option S Corporation Franchise Or Income Tax Return 2011 in PDF format just by clicking the DOWNLOAD PDF. The forms on this page are provided in Adobe Acrobat Portable Document Format PDF.

The following is a brief step by step guide. The Direct pay option is safe and easy to use and can be done in few simple steps in one online session when you click on the payment tab on the IRS website. HM Revenue and Customs Option to Tax National Unit 123 St Vincent Street GLASGOW G2 5EA Phone 0300 200 3700 Scanned copies of this.

For further information phone the VAT Helpline on 0300 200 3700. These PDF forms are fully accessible but there is no computation validation or verification of the. Send this form to.

Try it for Free Now. Free File Fillable Forms is the only IRS Free File option available for taxpayers whose 2021 income AGI is greater than 73000. For more information see Form 6251 Alternative Minimum TaxIndividuals and its instructions.

Open IRS Form 1040ES. Find prior years forms instructions publications. Follow the step-by-step instructions below to design youre vat5l form.

Section 3 of Notice 742A Opting to tax land and buildings. Accessible versions for people with disabilities. Where to send this form.

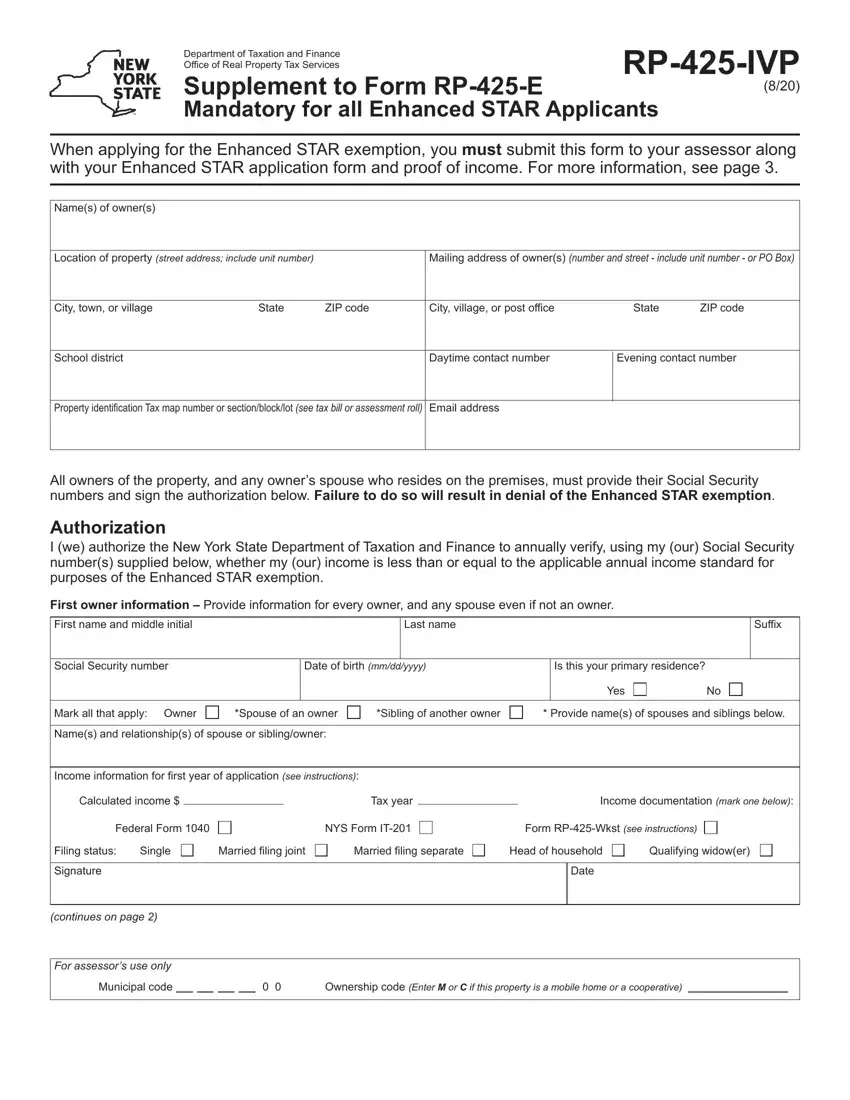

Ad Download A Fillable 2022 w9 form. Form it is strongly recommended that you read Notice 742A Opting to tax land and buildings available from our website go to wwwhmrcgovuk A paper copy and general guidance are. Use this form only to notify your decision to opt to tax land andor buildings.

Taxpayers whose income is 73000 or less qualify for IRS Free. Select the document you want to sign and click Upload. For a copy go to wwwgovuk and enter Notice 742A in the search box.

Use form VAT1614D to disapply the option to tax buildings for conversion into dwellings. Use e-Signature Secure Your Files. Fill Out Fields Make an IRS W-9 Print File W-9 Start For Free.

Ad Access IRS Tax Forms. Opting to tax land and buildings. Decide on what kind of signature to.

You should use form VAT1614C to revoke an option to tax land and buildings for VAT purposes within the 6 month cooling off period. Use this form if you want to revoke an option to tax land or buildings within 6 months of the date the option took effect. Your input tax Do you wish to recover any pre-option input tax.

VAT 1614A Opting to tax land and buildings Notification of an option to tax Subject.

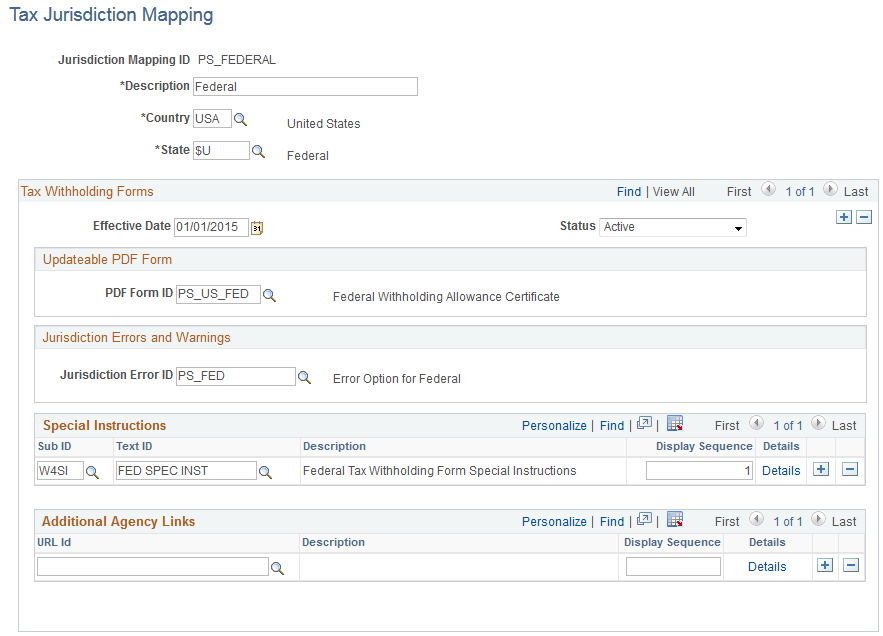

Setting Up Updateable Pdf Tax Forms

Vat5l Fill Out And Sign Printable Pdf Template Signnow

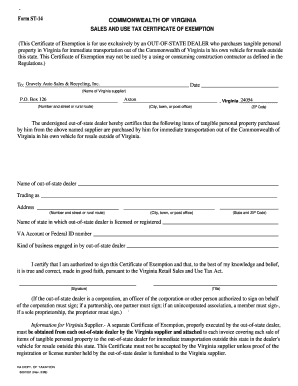

Virginia Resale Certificate St 14 Fill Out And Sign Printable Pdf Template Signnow

Revoke An Option To Tax After 20 Years Have Passed Gov Uk

Fillable Online Form Doc Authorization Request Form Pdf Fax Email Print Pdffiller

Free 6 Sample Self Employment Tax Forms In Pdf

How To Use The Taxes Page Taxbit

Irs Creates New 1040 Sr Tax Return For Seniors The Good Life

Fill Free Fillable Irs Pdf Forms

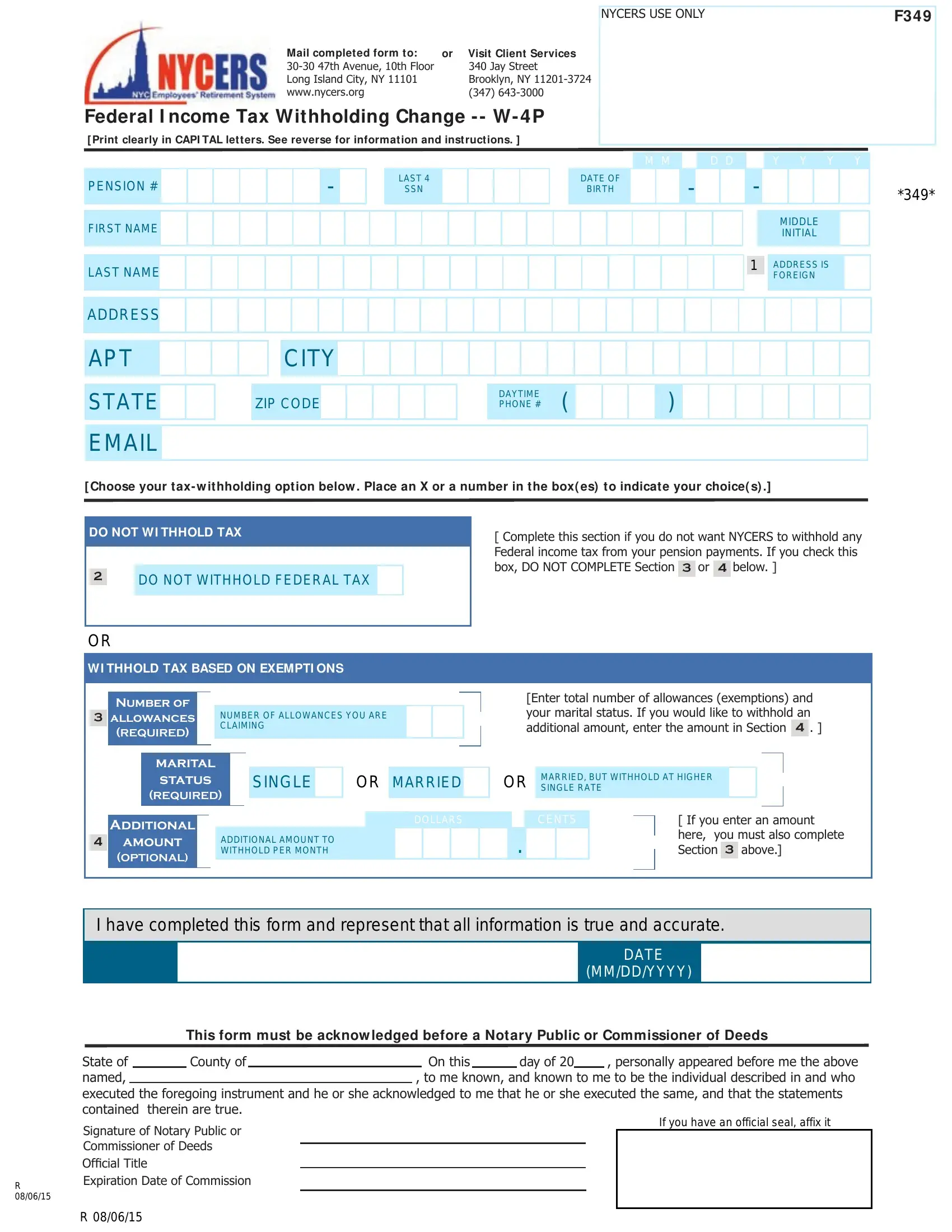

Nycers Form F349 Fill Out Printable Pdf Forms Online

Free Texas Power Of Attorney Forms 9 Types Word Pdf Eforms

How To Fill Out Pdf Forms On Iphone Fill Out Forms On Ipad

How To Convert Form 1099 S And W2 S Into Pdf Format Files

/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition And Filing